Joint Tenants or Tenants in Common? What’s the difference? Find out from the Butler McDermott Lawyers Property Law team’s Sunshine Coast conveyancing solicitors.

When purchasing property with another person, one of the first questions property conveyancing solicitors will ask is whether you are purchasing as joint tenants or tenants in common.

Understanding and choosing the correct tenancy option is important as it will affect what happens when one of the owners dies.

Whilst both joint tenants and tenants in common arrangements will give each person ownership rights to the property, there are essential differences and rules which govern each tenancy option under Property Law.

Joint Tenants

Where parties own property as joint tenants, under Property Law it means that:

- Parties have equal ownership of the property (100% each); and

- a right of survivorship exists.

The right of survivorship means that when one joint tenant dies, the deceased’s share automatically passes to the surviving joint tenant and does not form part of the estate of the deceased. There is a lot of benefits to the right of survivorship, particularly for couples where they expect all their assets to transfer to their spouse on their death.

Tenants in Common

Where parties own property as tenants in common, under Property Law they own the property in percentages. Those percentages may be equal or not. For example, two people may own a property 50/50 or 60/40 or 99/1.

Contrary to joint tenants, the right of survivorship does not exist in tenants in common arrangements. Hence, if one dies, the deceased’s interest transfers in accordance with their Will and does not (necessarily) pass to the other co-owner(s) of the property.

What works for you?

Each situation is different and you can discuss with your property conveyancing lawyers, the effect of either option.

Joint tenancy is common for married couples or couples in long-term relationships due to the right survivorship.

However, in most other cases, if you are buying with business partners, friends and/or siblings, tenants in common is usually more appropriate. It allows you clearly define what percentage of ownership each owner has. Further, if you die, your interest in the property will form part of your assets which transfer in accordance with your Will.

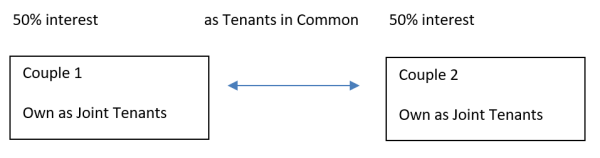

In some cases, there can be a mixture of both options. For example, if two couples bought an investment property together, they might own the property –

For further tenancy enquiries, feel free to contact the Sunshine Coast conveyancing solicitors from Butler McDermott Lawyers Property Law team in Nambour for a confidential discussion.